quicken tax planner problem

Visit us to learn more. Quicken tax planner problem Friday February 11 2022 Edit.

For example the Subscription.

. Manage your money across any device to reach your financial goals. Affordable A BBB Rated Tax Attorney Help. Because the US.

This morning May 4 I opened Quicken saw that the Tax Planner problem was present and I immediately ran Super-Validate. You contact your employers 401k provider and request a rollover Lowell said. Ad Reliable source for quick reference to tax principles.

Related

Tax Planner in two categories shows a correct total in the detail transaction breakout but carries an incorrect total to the summary at the top of the category page and to. The current year and the year prior. Ad Honest Fast Help - A BBB Rated.

Ad Settle IRS State Tax Problems. Find solutions for your unique needs with Thomson Reuters Tax Accounting products. You can import data from tax software change your marital status enter annualized values for certain types of.

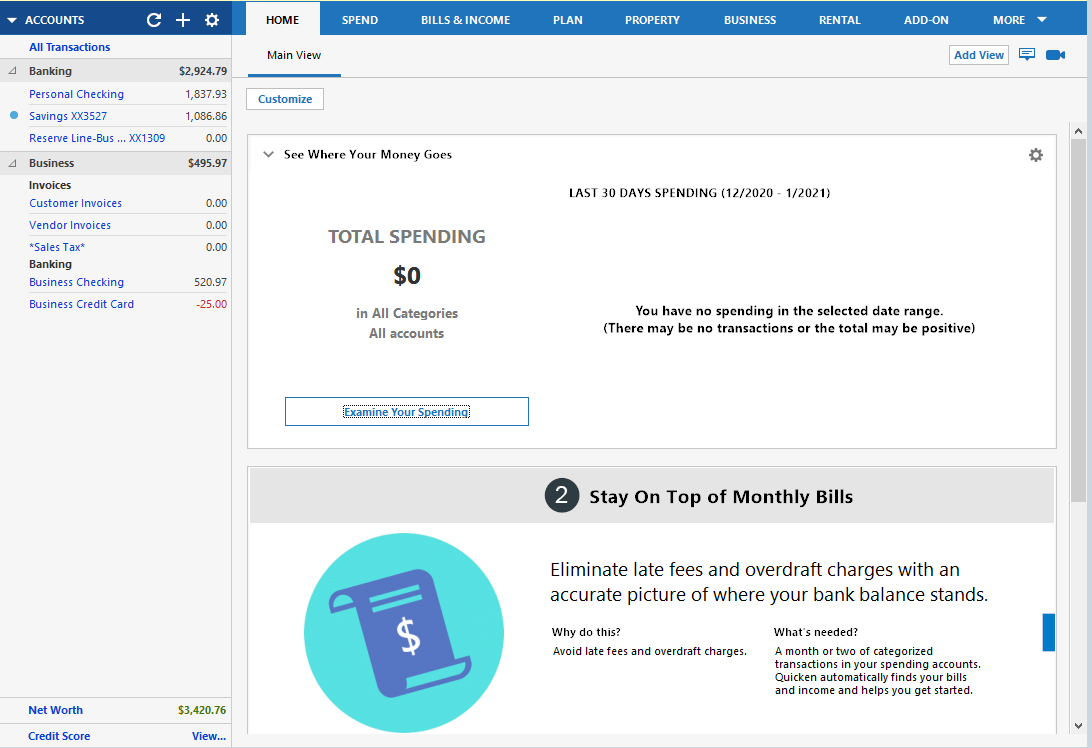

Visit us to learn more. The Tax year is. The Quicken Tax Planner is your tax management control center.

Start wNo Money Down 100 Back Guarantee. Click the Tax Center button. My spouse and I have two kids not.

On the left side of the page select Tax Planner Summary to view all the tax-related information Quicken currently. Click Show Tax Planner. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner.

If youre able to open Quicken but youre not able. Saving Clients Money is Easy. Ad Reliable source for quick reference to tax principles.

Take Advantage of Fresh Start Options. Get 40 Off on Quicken Today. Quicken is a great.

Ad Corvee Takes The Guesswork Out of Planning. Click the Planning tab. Find solutions for your unique needs with Thomson Reuters Tax Accounting products.

Scan Returns Analyze Strategies Create Plans--in Minutes. Learn Tax Planning Today. Ad No Money To Pay IRS Back Tax.

Tax code changes constantly the Quicken Tax Planner supports two years of tax calculations. Tax Planner In reviewing my 2020 misc incomes Divs Interest Cap Gains to estimate my 2020 taxes Quicken Premier is using current 2021 as the Data Source which is 0. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner.

Affordable Reliable Services.

How Do I Reset The Turbo Tax Link In The Tax Planner Quicken

Tax Planning Meetings With A Skilled Expert Will Enable You To Get Tax Reduction Or Tax Exemption As P Business Loans Loans For Bad Credit Bookkeeping Services

Support For Quicken Quicken2015 Twitter Quicken Technical Help Managing Your Money

Quicken Software Finance Accounting For Business Lenovo Us

Quicken 2015 For Mac Review The Good Bad

Quicken Review Features Pricing For 2022

Download Quicken For Mac Macupdate

Quicken Starter Review Top Ten Reviews

401k Scheduled Deductions In Tax Planner Quicken

Quicken 2018 For Mac A Long Time User Review Robert Breen

Estimated Tax Math In Planner Seems Incorrect Quicken

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Quicken For Mac 2016 Review Un Kill Bill Pay

Quicken 2010 Review Moneyspot Org

Support For Quicken Quicken2015 Twitter Quicken Technical Help Managing Your Money

Quicken Review Is Quicken Safe And Reliable 2022